Non-Profit Organizations, Ohio Law, and the Internal Revenue Code

4.6 (191) · $ 13.00 · In stock

The relationship and interaction between Ohio law governing not-for-profit organizations and the Internal Revenue Code provisions governing tax-exempt and charitable organizations can be confusing and often misunderstood. Many people assume that one necessarily means the other, which is not the case.

Most Common Lawsuits for Nonprofits - Emplicity PEO & HR Outsourcing

Understanding the Benefits of a Series LLC - Carlile Patchen & Murphy

Income - General Information

Employer Withholding Department of Taxation

Electing Pass-Through Entity: IT 4738

Nonprofit Compliance Guide, Harbor Compliance

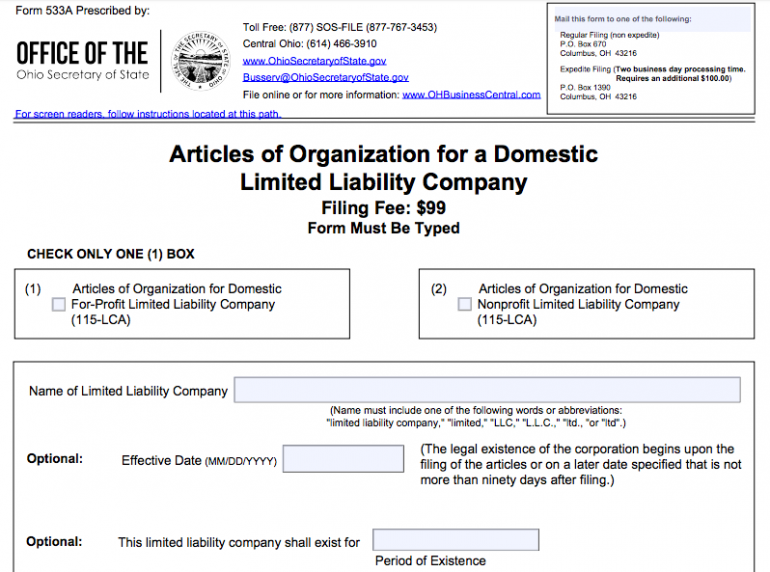

Forming an LLC in Ohio: A Step-by-Step Guide - NerdWallet

What are Taxable Gross Receipts Under Ohio's Commercial Activity Tax?

IRS targeting controversy - Wikipedia

Changes to Ohio's Commercial Activity Tax

Free Donation Receipt Template, 501(c)(3) - PDF