What Is Form 8586: Low-Income Housing Credit - TurboTax Tax Tips & Videos

4.5 (717) · $ 23.50 · In stock

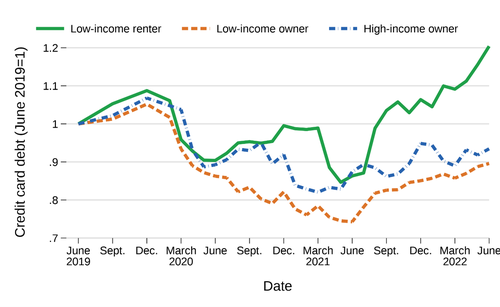

General business tax credits provide incentives for business activities beneficial to the American public or the economy in general. Owners of rental buildings in low-income housing projects may qualify for the low-income housing credit, which is part of the general business tax credit, using Form 8586 to calculate the amount of the credit.

What Is Form 8586: Low-Income Housing Credit TurboTax Tax, 55% OFF

Provincial tuition and education credit claimed by student is not

THE BEST 10 Accountants near EAST WINDSOR, NJ - Last Updated March

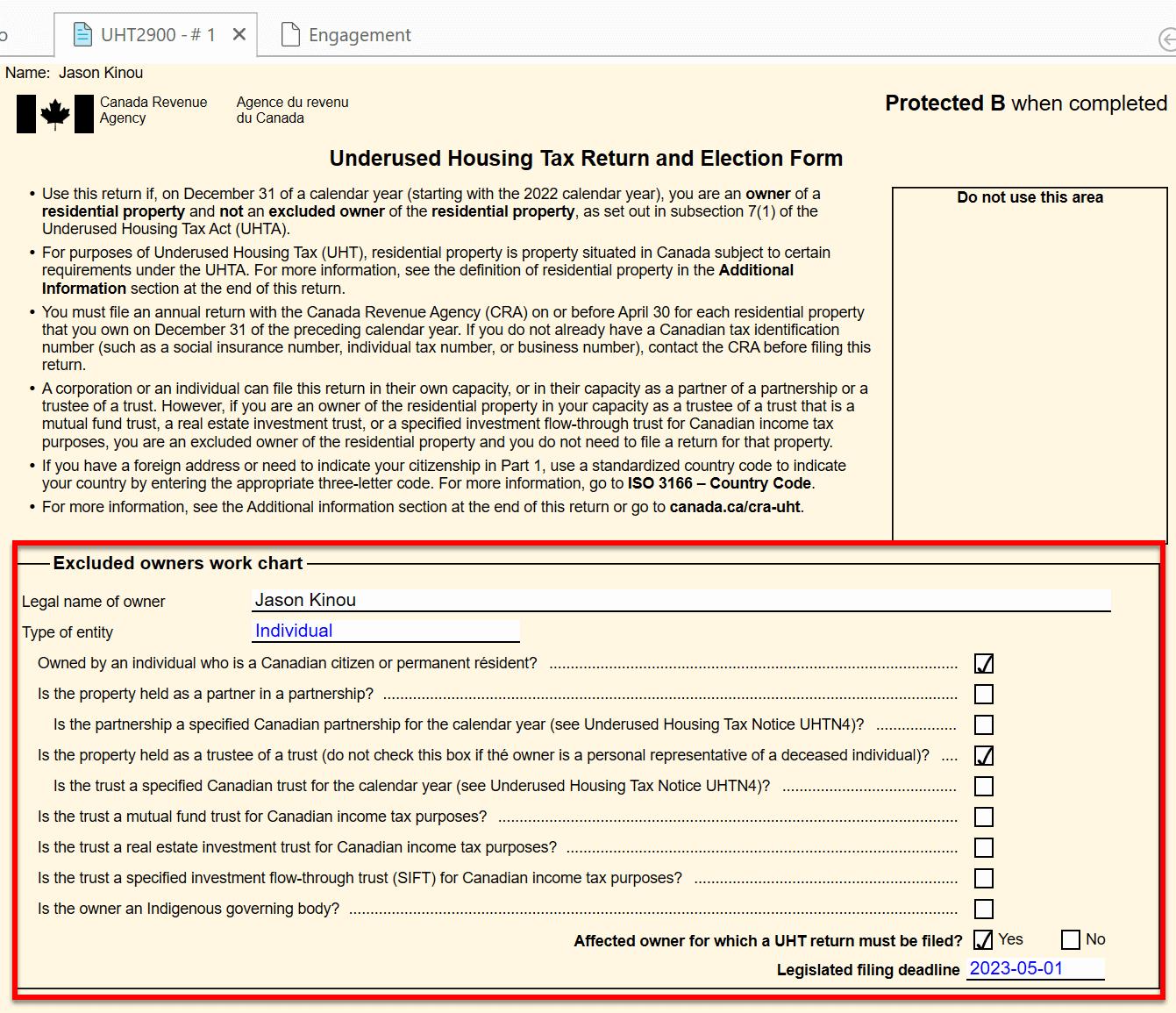

Underused Housing Tax Return (UHT-2900) - TaxCycle

Why are taxes so low in Florida? - Quora

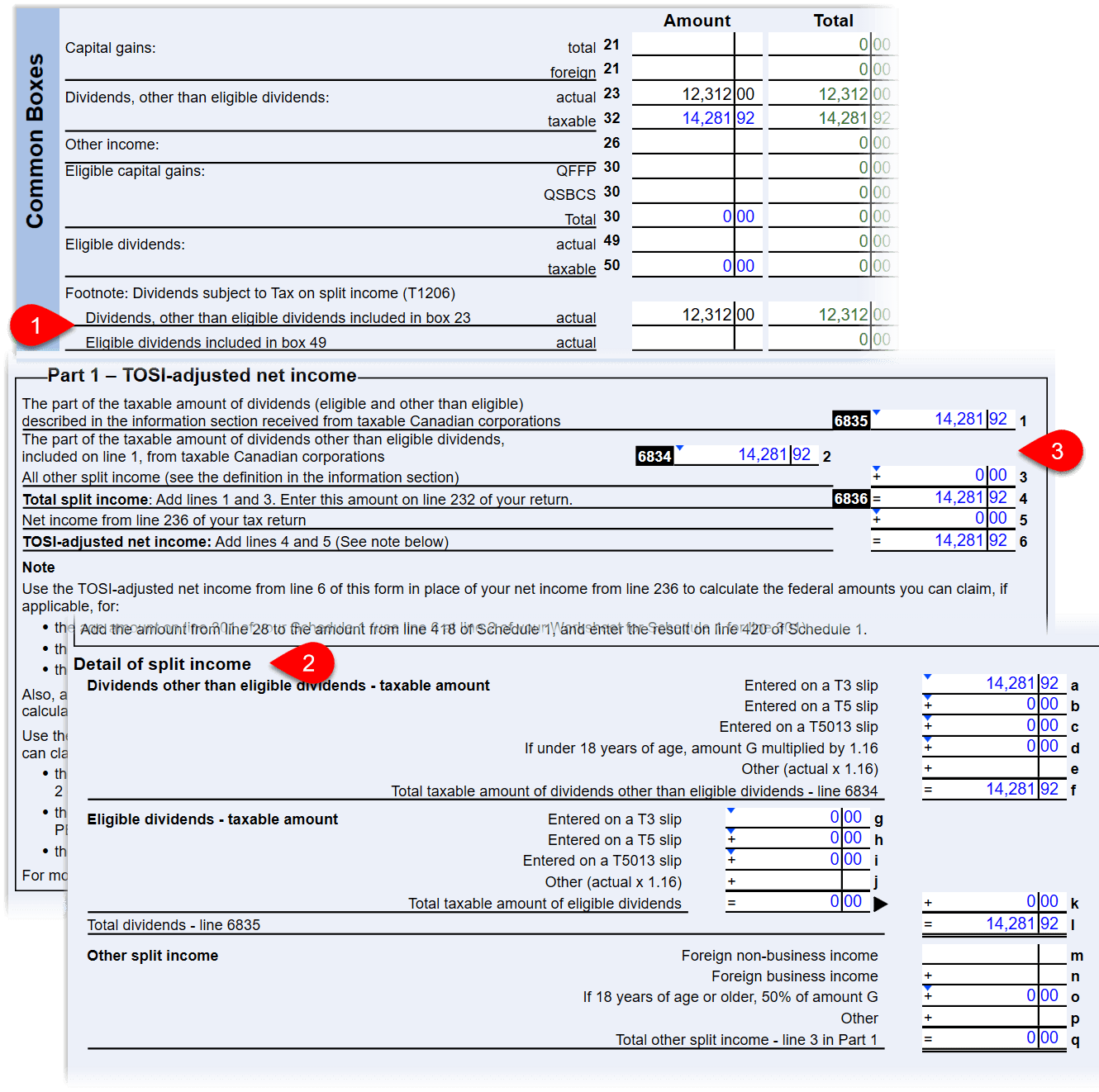

T1206 Tax on Split Income (TOSI) - TaxCycle

H&R Block vs TurboTax vs other Questionnaire For Claiming the

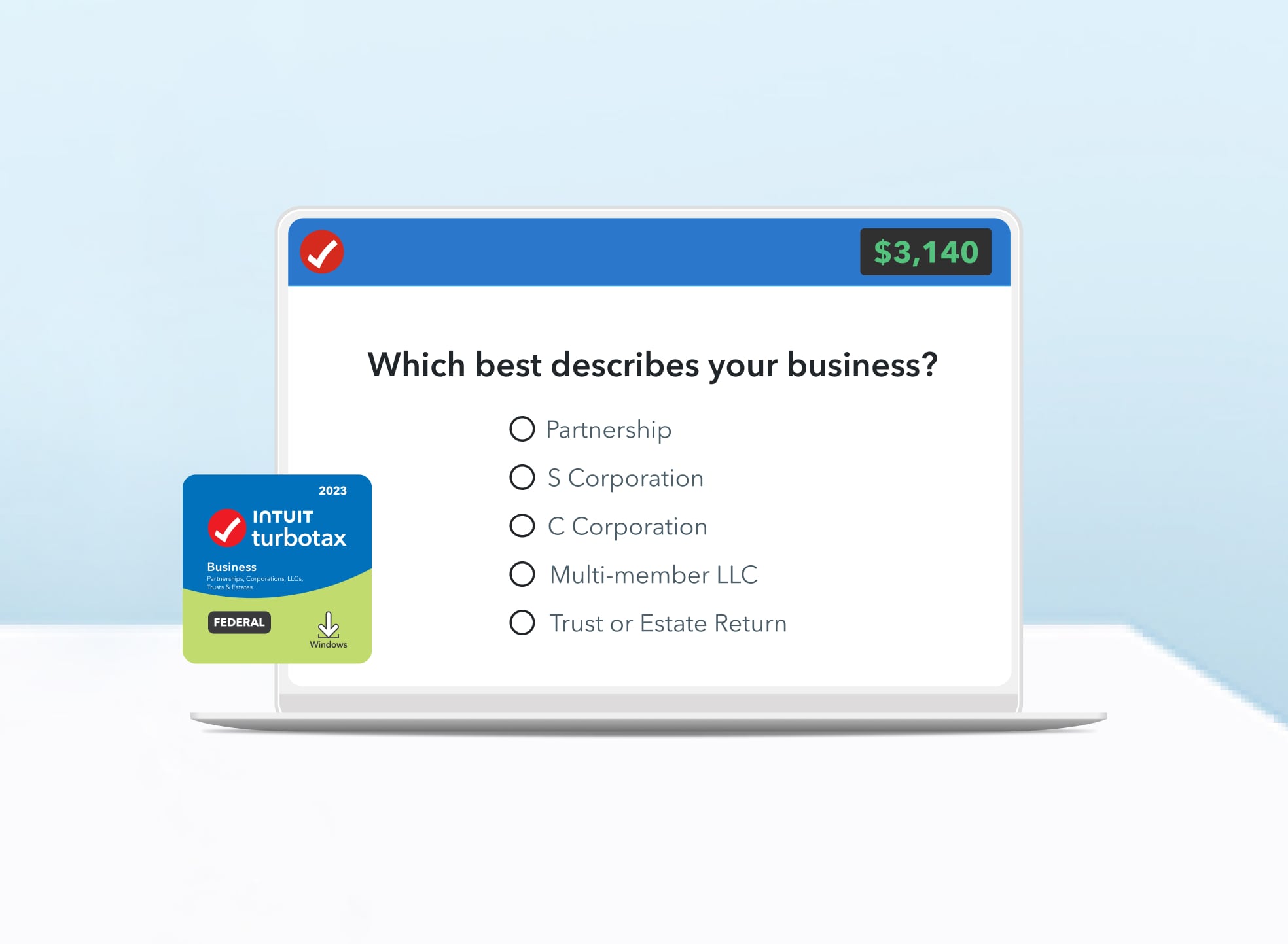

TurboTax® Business Desktop 2023-2024

What Is Form 8586: Low-Income Housing Credit TurboTax Tax, 55% OFF

What Is Form 8586: Low-Income Housing Credit TurboTax Tax, 55% OFF

TurboTax Premier Federal + State + Federal efile 2009

What Is Form 8586: Low-Income Housing Credit TurboTax Tax, 59% OFF

TurboTax® Live Assist & Review 2023-2024

TurboTax® Deluxe Desktop 2023-2024

IRS Form 8586 Walkthrough (Low-Income Housing Credit)