How Does a Wraparound Mortgage Work?

4.6 (152) · $ 8.50 · In stock

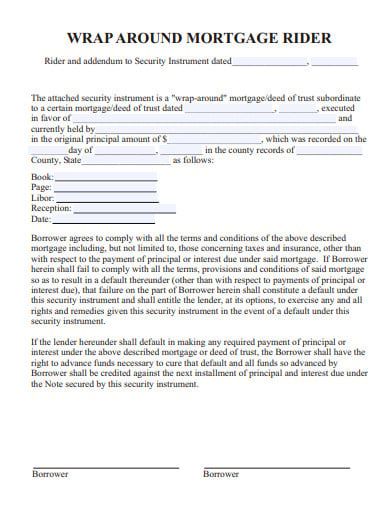

A wraparound mortgage allows a property seller to keep their original mortgage loan in place while they agree to finance the bulk of the purchase for a new buyer. The seller is effectively financing a subordinate mortgage for their buyer while keeping the original mortgage in place. It works much like a “subject to” purchase with a few key differences.

Assumable Mortgage - What It Is, Types, Pros & Cons, Examples

What is a 'wrap around' mortgage? - Quora

10+ Wraparound mortgage Templates in DOC

What Are Wraparound Mortgages In Texas? - Sheehan Law PLLC

Understanding Wraparound Mortgages: Managing Interest Rates with Ease - FasterCapital

:max_bytes(150000):strip_icc()/buying-subject-to-an-existing-loan-1798423-27ea8f47081b44c7b2ba85a2326595e2.jpg)

How Subject-To Loans Work in Real Estate

What is a Seller Finance Wrap Around Mortgage

Wraparound Mortgages: A Unique Approach to Financing Your Dream Home - FasterCapital

Understanding Wraparound Mortgages: Managing Interest Rates with Ease - FasterCapital

What Is A Wraparound Mortgage?